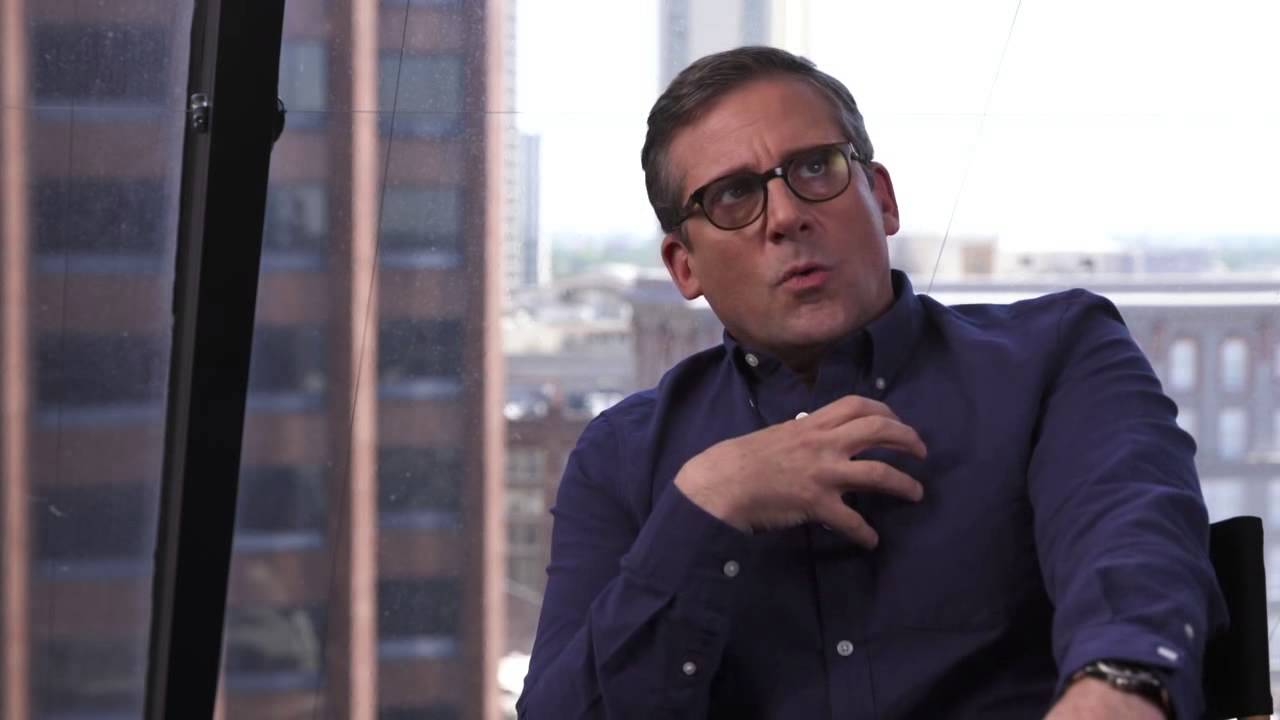

The release of "The Big Short" in 2015 brought to light the intricate and tumultuous events leading up to the 2008 financial crisis. At the heart of this narrative is the character Mark Baum, portrayed by Steve Carell, whose real-life counterpart is Steve Eisman. This film, which is based on Michael Lewis's book, showcases how Baum's skepticism and determination played a pivotal role in exposing the fragility of the financial system. The impact of Mark Baum in "The Big Short" is not just a cinematic achievement but a reflection of a financial revolution that reshaped Wall Street and the global economy.

Mark Baum's journey in "The Big Short" is characterized by his relentless pursuit of truth and justice in the financial world. As a hedge fund manager, he delved deep into the complexities of mortgage-backed securities and the housing market bubble, uncovering the deceit and greed that had become rampant. His insights and actions not only highlighted the impending collapse but also underscored the need for accountability and reform within the financial sector. Through his character, audiences gain a deeper understanding of the systemic issues that led to the financial meltdown and the transformative impact of those who dared to challenge the status quo.

The financial revolution sparked by the events depicted in "The Big Short" continues to influence the financial industry today. Mark Baum's impact serves as a reminder of the importance of vigilance, integrity, and the power of informed individuals to drive change. As the world continues to navigate the complexities of modern finance, Baum's story remains a testament to the enduring significance of questioning and understanding the forces that shape our economic landscape.

| Personal Details | Information |

|---|---|

| Real Name | Steve Eisman |

| Portrayed as | Mark Baum |

| Occupation | Hedge Fund Manager |

| Famous for | Predicting the 2008 Financial Crisis |

Table of Contents

- Biography of Mark Baum

- Early Life and Career

- How Did Mark Baum Foresee the Crisis?

- The Big Short: A Cinematic Masterpiece

- What Are Mortgage-Backed Securities?

- The Role of Credit Default Swaps

- Impact of Mark Baum in The Big Short

- Financial Revolution and Reforms

- What Lessons Can We Learn from The Big Short?

- Mark Baum as an Icon of Financial Transparency

- The Legacy of Mark Baum

- How Did The Big Short Influence the Financial World?

- The Importance of Financial Literacy

- Frequently Asked Questions

- Conclusion

Biography of Mark Baum

Mark Baum, whose real-life inspiration is Steve Eisman, emerged as a significant figure during the 2008 financial crisis. Born into a family with a strong financial background, Baum's understanding of economics and finance was deeply ingrained from a young age. His career path led him to become a hedge fund manager, where he gained insights into the workings of Wall Street.

Baum's professional journey was marked by his distinct approach to investment and finance. Unlike many of his contemporaries, he was known for his critical thinking and skepticism towards the financial market's status quo. This characteristic skepticism would later become instrumental in identifying the flaws within the mortgage-backed securities and the broader financial system.

Early Life and Career

Mark Baum's early life was shaped by his family's influence in the financial sector. He pursued higher education with a focus on economics, which equipped him with the analytical skills necessary for a career in finance. His early career saw him working with notable financial institutions, where he honed his expertise in investment strategies and market analysis.

Throughout his career, Baum demonstrated a keen ability to identify market trends and potential risks. This ability became particularly evident as he navigated the complexities of the housing market and mortgage-backed securities, setting the stage for his significant role in "The Big Short."

How Did Mark Baum Foresee the Crisis?

The foresight of Mark Baum in predicting the 2008 financial crisis was a result of his meticulous analysis and deep understanding of financial instruments. He closely examined the mortgage-backed securities market and identified the inherent risks associated with subprime mortgages.

Baum's skepticism of the seemingly robust housing market led him to delve deeper into the data, uncovering the alarming levels of delinquency and default. His ability to connect the dots between these indicators and the potential collapse of the financial system was a testament to his expertise and intuition.

The Big Short: A Cinematic Masterpiece

"The Big Short," directed by Adam McKay, is a film adaptation of Michael Lewis's book that captures the events leading up to the 2008 financial crisis. The film masterfully depicts the complexities of the financial world through the eyes of mavericks like Mark Baum, who dared to challenge the conventional wisdom of Wall Street.

Through its engaging narrative and stellar performances, "The Big Short" educates audiences about the intricacies of the financial system and the pivotal role played by individuals like Baum. The film's impact extends beyond entertainment, serving as a cautionary tale about the dangers of unchecked greed and the importance of financial innovation.

What Are Mortgage-Backed Securities?

Mortgage-backed securities (MBS) are financial instruments that bundle together a group of home loans, which are then sold to investors. These securities allowed for greater liquidity in the mortgage market and provided investors with a steady stream of income based on the interest payments from these loans.

However, the proliferation of subprime mortgages—loans given to borrowers with poor credit histories—led to a significant increase in the risk associated with MBS. As defaults on these loans increased, the value of MBS plummeted, contributing to the financial crisis.

The Role of Credit Default Swaps

Credit default swaps (CDS) are financial derivatives that act like insurance against the default of a borrower. They played a significant role in the 2008 financial crisis by allowing investors to bet against the mortgage market.

Mark Baum, along with other key figures in "The Big Short," utilized CDS to hedge against the impending collapse of mortgage-backed securities. This strategic move not only underscored the potential for financial innovation but also highlighted the need for regulatory oversight in the derivatives market.

Impact of Mark Baum in The Big Short

The impact of Mark Baum in "The Big Short" extends beyond the film's narrative. His character embodies the critical examination and skepticism necessary to challenge the financial system's vulnerabilities. Baum's actions and insights catalyzed a financial revolution, prompting a reevaluation of risk management and regulatory practices within the industry.

His story is a powerful reminder of the importance of questioning established norms and advocating for transparency and accountability in the financial sector. Mark Baum's legacy continues to influence the way we perceive and engage with the financial world.

Financial Revolution and Reforms

The aftermath of the 2008 financial crisis brought about significant reforms aimed at preventing a recurrence of such an event. The Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted to increase transparency and accountability in the financial industry.

Mark Baum's role in "The Big Short" highlights the necessity of these reforms and the ongoing financial revolution that seeks to create a more resilient and equitable financial system. This revolution emphasizes the importance of responsible lending, risk management, and regulatory oversight.

What Lessons Can We Learn from The Big Short?

"The Big Short" offers valuable lessons about the complexities of the financial system and the consequences of unchecked greed. It underscores the importance of due diligence, skepticism, and the need to question prevailing assumptions in the financial world.

Audiences are reminded of the significance of financial literacy and the impact of informed decision-making. The film serves as a call to action for individuals and institutions to prioritize transparency and accountability in their financial dealings.

Mark Baum as an Icon of Financial Transparency

Mark Baum's character in "The Big Short" has become synonymous with financial transparency and integrity. His unwavering commitment to uncovering the truth and challenging the status quo has made him an icon for those advocating for a more transparent financial system.

Baum's legacy continues to inspire individuals and organizations to uphold the principles of honesty and accountability in their financial practices. His story serves as a reminder of the power of informed individuals to drive meaningful change in the financial industry.

The Legacy of Mark Baum

The legacy of Mark Baum is one of courage, integrity, and a relentless pursuit of truth. His role in "The Big Short" has left an indelible mark on the financial world, inspiring a new generation of financial professionals to prioritize ethics and transparency.

Baum's impact extends beyond the film, serving as a catalyst for ongoing discussions about the need for reform and accountability in the financial sector. His story is a testament to the enduring power of individuals to effect change and shape the future of finance.

How Did The Big Short Influence the Financial World?

The release of "The Big Short" had a profound impact on the financial world, sparking renewed interest and debate about the causes and consequences of the 2008 financial crisis. The film brought to light the systemic issues within the financial industry and underscored the need for continued vigilance and reform.

By highlighting the actions of individuals like Mark Baum, "The Big Short" has inspired a greater focus on financial literacy, risk management, and the importance of questioning established norms. The film's influence continues to resonate within the industry, driving ongoing efforts to create a more transparent and equitable financial system.

The Importance of Financial Literacy

The story of "The Big Short" and the impact of Mark Baum underscore the critical importance of financial literacy. Understanding the complexities of the financial system is essential for making informed decisions and navigating the challenges of modern finance.

By promoting financial literacy, individuals and organizations can better understand the risks and opportunities within the financial market, leading to more responsible and sustainable financial practices. Mark Baum's story serves as a powerful reminder of the value of education and awareness in driving positive change.

Frequently Asked Questions

What role did Mark Baum play in "The Big Short"?

Mark Baum, based on the real-life Steve Eisman, was a key figure in "The Big Short." He was a hedge fund manager who foresaw the collapse of the housing market and bet against mortgage-backed securities, highlighting the systemic issues within the financial industry.

How did "The Big Short" impact the financial industry?

The film brought widespread attention to the causes and consequences of the 2008 financial crisis, prompting discussions about the need for reform and accountability in the financial sector. It has inspired greater focus on financial literacy and transparency.

What lessons can be learned from Mark Baum's story?

Mark Baum's story emphasizes the importance of skepticism, due diligence, and questioning established norms in the financial world. It highlights the need for transparency, accountability, and informed decision-making to prevent future financial crises.

How are mortgage-backed securities related to the 2008 crisis?

Mortgage-backed securities, which bundled home loans into financial instruments sold to investors, played a significant role in the 2008 crisis. The proliferation of subprime mortgages led to increased risk and ultimately contributed to the financial collapse.

What reforms were implemented after the 2008 crisis?

The Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted to increase transparency and accountability in the financial industry. These reforms aimed to prevent a recurrence of the events leading to the 2008 crisis and promote a more resilient financial system.

Why is financial literacy important?

Financial literacy is essential for understanding the complexities of the financial system and making informed decisions. It helps individuals and organizations navigate risks and opportunities, leading to more responsible and sustainable financial practices.

Conclusion

The impact of Mark Baum in "The Big Short" as a financial revolution cannot be overstated. His story is a powerful testament to the importance of integrity, transparency, and the courage to challenge established norms in the financial world. Through his actions, Baum not only anticipated one of the most significant financial crises in history but also inspired a renewed focus on reform and accountability within the industry.

As we continue to navigate the complexities of modern finance, the lessons learned from Mark Baum's journey are more relevant than ever. His legacy serves as a reminder of the enduring power of informed individuals to drive meaningful change and shape the future of the financial world. By prioritizing financial literacy and embracing the principles of transparency and accountability, we can work towards a more equitable and resilient financial system for generations to come.

For further reading, you can explore more about the real-life events depicted in "The Big Short" through credible sources such as the U.S. Securities and Exchange Commission.